In the first installment of this diagnosis, we analyzed how the disconnection from physical space and the use of generic references shape immersive audio practice in our region. However, the survey (which, to date, consolidates the voices of more than a hundred participating professionals and specialists) reveals an even deeper layer of friction: operational instability.

If talent is not the problem, structure is. This second part delves into the data that explain why immersive workflows in Latin America so often feel like a house of cards.

When budget dictates architecture

The economic factor is the first wall in this diagnosis: 78.9% of immersive audio professionals in Latin America invest less than USD 500 per year in licenses and subscriptions.

In an industry that promotes closed ecosystems and monitoring systems costing thousands of dollars more than that, this statistic does not point to a lack of professionalism, but to an insurmountable market asymmetry.

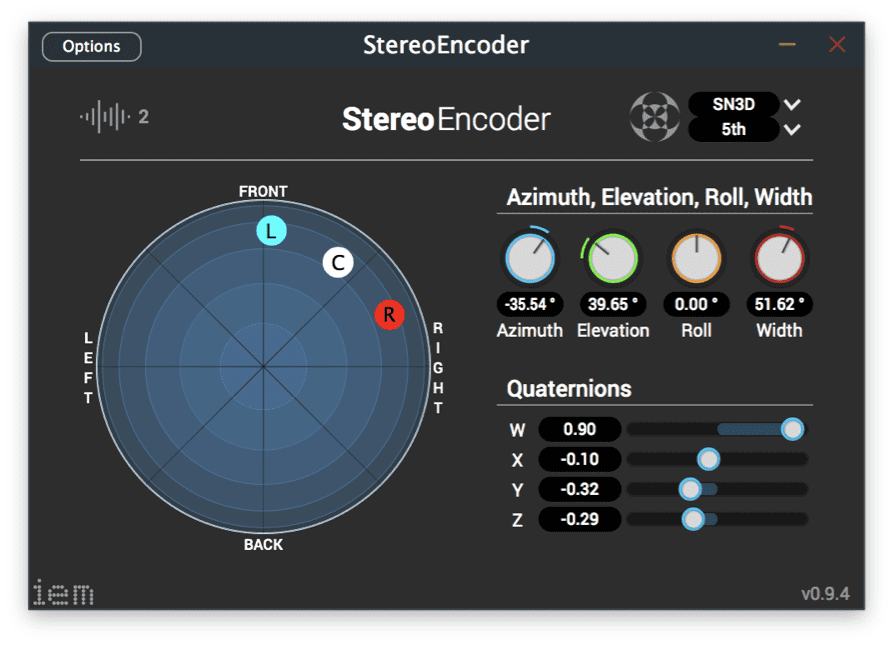

In Latin America, immersive audio does not arrive as a finished product or a turnkey package ready for use. On the contrary, it is an artisanal infrastructure that professionals must build from the ground up, sustained by an architecture of patches and technical resilience. It is a web of diverse tools and customized workflows that engineers must coordinate to reach global standards (standards that proprietary software rarely guarantees outside certified ecosystems).

Tactical and strategic investment to compete at a global level

Despite this restrictive landscape, the data reveal a high-commitment professional paradox in which Latin America moves away from the “low-cost” market myth to position itself as one of the strategic priority regions.

Although current spending on software licenses remains relatively low, the survey reveals a strong willingness to invest in hardware and critical tools when their professional value is clear, tangible, and directly tied to work generation. 42.1% of respondents report being prepared to invest between USD 501 and USD 2,000 annually, while 15.8% (a particularly significant segment) are willing to allocate between USD 2,001 and USD 5,000 to strategic equipment such as multichannel interfaces, ambisonic microphones, or professional monitoring systems.

This demonstrates that professionals in Latin America are not looking for the easy path. There is a deep commitment to the craft, where saving, prioritizing, and making significant sacrifices are part of acquiring the best tools the context allows. The use of informal channels or open-source suites is, in many cases, a forced response to the lack of scalable licensing models. In fact, more than 52% of specialists state that they would significantly increase their investment if pricing were adjusted to regional realities.

The message for companies and developers is direct. Professionals in our region invest when there is economic viability and a clear link between the tool and its ability to generate work. If software offered licensing models aligned with local realities and technical support that enabled users to fully master and capitalize on the tool, investment would be a logical outcome rather than an exception. In the current scenario, professionals are not simply purchasing software; they are financing their own operational autonomy. They are not merely using a tool, but projecting the quality of their work onto it and assuming the cost of sustaining it in an environment that rarely makes that effort easier.